capital gains tax proposal details

The top capital gains tax rate would be 25. Long-term capital gains are gains on assets you hold for more than one year.

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

The Democrats Tax Plan Would Raise Capital Gains and Corporate Tax Rates.

. This legislation calls for increasing the top individual tax rate from 37 to 396 and raising the capital gains tax rate from 20 to 396 for taxpayers with incomes higher than 1 millionand even higher for those required to pay the net investment income tax. In the American Families Plan AFP the Biden Administration is proposing an increased tax rate on capital gains and qualified dividends to equal the top ordinary income tax rate of 396 for households earning over 1 million or 500000 if married filing separately. The House Ways Means Committee has released draft legislation of individual tax hikes they propose to pay for the 35 trillion social policy budget plan under consideration.

This will affect long-term and short-term capital gains since both would be taxed as ordinary income in the highest bracket. Under the current proposal outlined in the Green Book there will be a realization of capital gains to the extent such gains are in excess of a. Monday saw the release of the Democrats full tax proposal which details their plan to pay for expanding access to paid family leave education and healthcare as well as efforts to combat climate changeThe proposal is expected to provide more than 2 trillion in new revenue over.

Here are the details of Bidens plan to tax capital gains. Bidens campaign proposal regarding capital gainsthe details. Employee owners must have acquired capital stock while employed by the corporation for at least 10 years.

Qualified corporations must have done business in Iowa for a minimum of 10 years. Theyre taxed like regular income. The state would apply a 9 percent tax to capital gains earnings above 25000 for individuals and 50000 for joint filers.

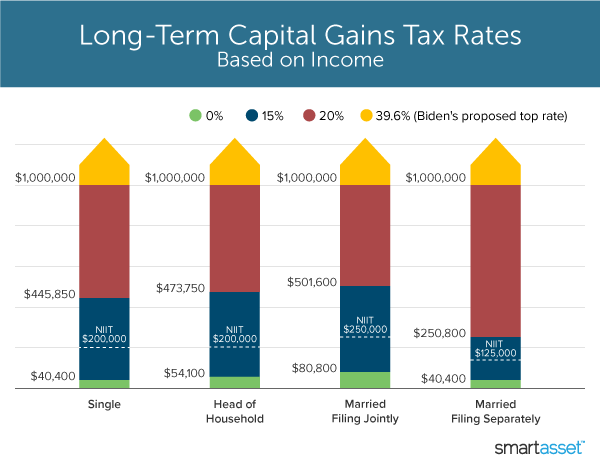

The top tax rate on dividends and long-term capital-gains would rise to 25 from 20 and would apply when income reaches 400000 for. Governor Inslee is proposing a capital gains tax on the sale of stocks bonds and other assets to increase the share of state taxes paid by Washingtons wealthiest taxpayers. The current long-term capital gains tax rates are 15 20 or 238 for higher income taxpayers.

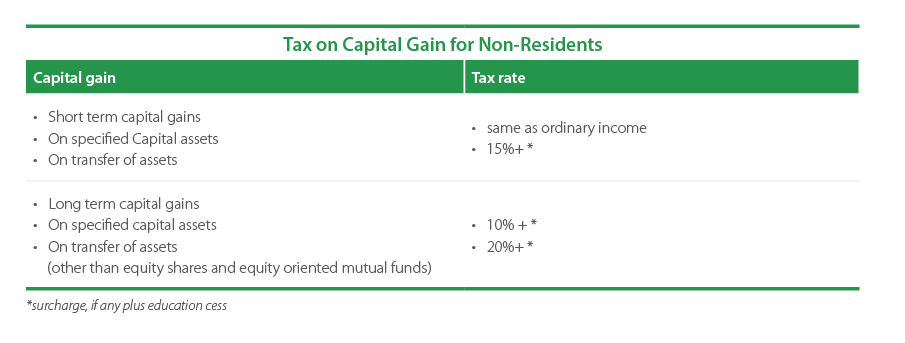

Democratic presidential candidate Hillary Clinton has proposed a change in the top capital gains tax rates. The proposal would allow 100 of the net capital gains to be deducted. Besides this the both long term and short term capital gains are taxable in case of debt mutual funds.

Tax long-term capital gains as ordinary income for taxpayers with adjusted gross income above 1 million resulting in a top marginal rate of 434 percent when including the new top marginal rate of 396 percent and the 38 percent Net Investment Income Tax NIIT. Subscribe to receive email or SMStext notifications about the Capital Gains tax. Biden proposed raising the top capital gains tax from 20 to 396 before a joint session of Congress on April 28.

It includes major revisions to the estate tax capital gains taxes and the way retirement accounts are taxed. Taxpayers with an income of over 1M could lose their preferential 20 treatment on long-term capital gains. Understanding Capital Gains and the Biden Tax Plan.

Depending on your regular income tax. Theyre taxed at lower rates than short-term capital gains. The top 1 percent of earners would experience a 08 percent increase in after-tax income in 2022 due to a more generous SALT deduction.

If this happens it means they would be taxed at ordinary income tax rates as high as 396. The STCGs on debt MF are added to the income of the taxpayer and is taxed. The 2021 Washington State Legislature recently passed ESSB 5096 RCW 8287 which creates a 7 tax on the sale or exchange of long-term capital assets stocks bonds business interests or other investments and many tangible assets if the profits exceed 250000 annually.

The capital gains tax in India under Union Budget 2018 10 tax is applicable on the LTCG on sale of listed securities above Rs1lakh and the STCG are taxed at 15. Real estate or business interests would not be taxed annually Wyden said but billionaires would still pay a capital gains tax including. The plan would increase the top corporate tax rate to 265 from 21 impose a 3-percentage-point surtax on people making over 5 million and raise.

Under current law such capital gains have a two-tiered structure. Short-term capital gains are gains you make from selling assets that you hold for one year or less. Assets other than stocks may have different rates for capital gains taxes.

Under current law 50 of net capital gains from an ESOP is allowed for deduction. President Joe Biden proposed a top federal tax rate of 396 on long-term capital gains and qualified dividends. The proposals would increase the after-tax income of the bottom quintile by about 152 percent in 2022 on a conventional basis which is largely driven by the expanded child tax credit CTC.

House Democrats on Monday proposed raising the top tax rate on capital gains and qualified dividends to 288 one of several tax reforms aimed at wealthy Americans to help fund a 35 trillion. CNBCs Ylan Mui reports the details of a possible big hike in capital gains tax that sent a shockwave down. Short-term gains face a top rate of 434 percent including the 396 percent statutory rate plus the 38 percent investment income surtax and long-term gains defined as those with.

That means you pay the same tax rates you pay on federal income tax.

Capital Gains Tax In India An Explainer India Briefing News

There Are Serious Financial Considerations To Take Into Account When Deciding To Move Abroad Cautions Theunis Ehlers A D Move Abroad Financial Financial Tips

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

How To Calculate Capital Gain Tax On Sale Of Land Abc Of Money

Long Term Capital Gain Calculator For Financial Year 2017 18 For Buildi Capital Gain Financial Term

Budget 2022 Will Capital Gains Tax Be Rationalized Across Asset Classes

What S In Biden S Capital Gains Tax Plan Smartasset

All About Capital Gains Tax How To Calculate Income From Capital Gains Indexation Concept Youtube

:max_bytes(150000):strip_icc()/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Capital Gains On Home Sales What Is Capital Gains Tax On Real Estate Guaranteed Rate

/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Accounting Taxation Income Tax Deductions Lic Donation Mediclaim Pension Fund Home Loan Repayment Bank Fdr Etc Ca Income Tax Tax Deductions Tax Refund

Simpler Structure Capital Gains Taxes May Be Up For Review The Financial Express